CIBIL score is very important but not known to many of us. Every one of us needs to be aware about CIBIL score and it is our own responsibility to keep our score high. The full form of CIBIL is Credit Information Bureau (India) Limited.

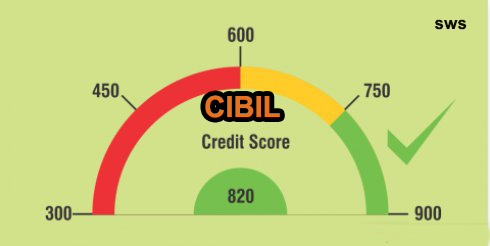

Simply put, it is a mark given to us by assessing how disciplined we are in handling finances. The minimum score is 300 and the maximum score is 900. A higher score indicates that you are a creditworthy person and more likely to get a loan from a financial institution.

When you apply for a credit card or any loan in a bank, without your knowledge, they find out your CIBIL score and then decide whether to grant the loan and how much interest/amount to pay. Applications are usually rejected if the score is too low. A score above 700 is generally good, and your loan applications are more likely to be successful.

How is CIBIL Score Calculated?

Credit Information Bureau (India) Ltd is an RBI approved organization that calculates the CIBIL score of each individual. All the banking and financial institutions in India forward the details of their customers’ loan and credit card transactions to CIBIL on a monthly basis. Essentially, you inform CIBIL about your EMI repayment delays, suspensions, credit card repayments and late payments. Using this data, CIBIL calculates each person’s score using their unique algorithm.

How to know your CIBIL score?

Go to CIBIL’s website and apply for the score by paying ₹550. Some banks like HDFC provide free score to their customers.

How to improve your CIBIL score?

- Pay off credit card payments, loan EMIs month after month without even a single day’s delay.

- Reduce the number of unsecured loans (credit card, personal loan).

- Limit cash transactions to 25-40% of the credit card limit.

- If you have more than one credit card, spread the spending across all of them.

- Do not apply for multiple loans at the same time, as this will count the score negatively.

CIBIL in UAE

Go to CIBIL’s website in UAE https://aecb.gov.ae/

OR

Download the AECB App, available on Google Play and the App Store.

Conclusion

In western countries like the US, credit score is used not only for loans, but also to determine insurance premiums, qualify for mobile plans, and even decide whether one is eligible to rent a house, and in the future, the same may happen in India.